ABOUT GOLD

The world’s central banks have been buying gold for years, and that trend could drive the price up over $2,000 next year, according to some experts. The problem is the ever-growing pile of public debt, which could be exacerbated by inflation next year.

Central banks deal with stimulus using gold

Noble Gold founder and CEO Collin Plume told Value Walk in an email that central banks will have to bear to brunt of “government generosity” by covering the costs of the many stimulus packages that have subsidized workers and businesses that couldn’t function during the lockdowns. However, that money will still need to be paid back, which causes three major challenges for central banks.

“They are all struggling with these issues simultaneously, and so borrowing amongst each other is not an option” Plume said. “Unemployment and bankruptcies will mean less tax revenue coming in to balance the books, and inflationary pressures are almost inevitable given the colossal figures involved. All of these realities will likely push prices for everyday household items higher (along with interest rates as well) at a time when people can least afford them – leading to recessionary fears down the line.”

According to Plume, this is the second-highest year on record for gold buying by central banks. He said the trend started to pick up momentum in 2018. This year central banks have already bought 651 tons of gold, and a larger pool of central banks have been buying gold for its diversification benefits. This pushed annual demand from them to its highest level since 1971.

“The most obvious countries adding gold to their reserves included Russia, China, Poland, Turkey, and Kazakhstan, while other countries, such as Poland and Germany, have begun to ‘repatriate’ their gold from other countries where it has been kept for safekeeping,” Plume explained.

Why central banks are buying gold

Plume explained that the main reason central banks want to hold gold is because of the stock-to-flow ratio, which compares the newly mined gold supply, or the flow, with above-ground stockpiles, or stock. He said new gold keeps getting added to the stockpile, amounting to about 1.5% per year. According to Plume, gold has a natural inflation rate of about 1.5%.

“If gold were money, it would be physically impossible to duplicate the rate at which the printing of fiat currency takes place,” he said. “Gold is finite, and as more ‘currency’ is printed, it becomes more valuable. Central banks of course know this, so in anticipation of them stepping up their printing of money, they buy gold to offset this. It comes down to simple supply and demand.”

For this reason, Plume expects the gold price to climb above $2,000 and stay there starting next year. He pointed out that U.S. national debt hit a new high of $27 trillion, which is an increase of almost 36% in less than four years. Plume added that it’s simply unsustainable to keep printing more money.

A year of uncertainty

RBC analyst Christopher Louney also thinks the gold story isn’t over yet. He noted that the gold price tumbled the most in months due to the news about the COVID-19 vaccine, but current price levels still leave plenty of unanswered questions. Louney pointed out that this has been a year of uncertainty which included a pandemic, economic crisis, heightened political tensions and plenty of drivers that have been positive for gold.

Even though the markets have appeared to be buoyant, he doesn’t believe investors have forgotten their fear. Louney added that the dollar has strengthened alongside real and nominal rates, which is bad for gold. However, he doesn’t believe those factors were enough to explain the steep drop in the gold price on their own.

He saw the decline as “a reset of gold-related pandemic expectations, a repricing of stimulus expectations by gold investors, a realignment of inflation fears and a shift in mindset around post-election political uncertainty.” Louney said the reset could have helped gold find a new equilibrium and noted that even after the first shipments of the vaccine, there will still be challenges in distribution and uptake, which means the health crisis won’t end immediately.

He is less positive on the gold price than Plume as he sees a price of $1,893 for next year with a low price of $1,628 and a potential high price of $2,608.

The global economy was flashing danger signs long before the pandemic. For one thing, many countries were clamouring to get hold of as much gold as possible. For the past decade, they have been buying new reserves and bringing it home from overseas storage to an extent never seen in modern times. Then just before the pandemic, there was a pause. What does all this mean?

Central banks added 650 tons to their reserves in 2019, the second highest shift in 50 years, after the 656 tons added in 2018. Before the 2007-09 financial crisis, central banks were net sellers of gold worldwide for decades. Leading the recent spree has been China, Russia, Turkey, Kazakhstan and Uzbekistan.

Venezuela started repatriating its gold in 2011, shipping 160 tonnes from New York. A third of its holdings remain in London, but only because the Bank of England won’t repatriate them – declaring it doesn’t recognise the government in Caracas. Venezuela has now made this the subject of a legal claim.

Between 2012 and 2017, Germany repatriated most of its massive reserve from Paris and New York to Frankfurt. The Netherlands did likewise in 2014, followed by Austria.

Central bankers look set to go on a gold buying binge this year in the wake of the Covid-19 pandemic, new research shows.

And the leading reason for the likely desire to buy bars of bullion is fear of another financial crisis, according to a recent report from industry group World Gold Council.

Central Banks Doubling Down on Gold

The survey showed that 20% of the banks that responded to the survey said their central bank would likely increase their gold holdings, versus 8% of those responding the same question a year ago. That’s more than double the percentage.

Central Banks have been on something of a buying binge recently and the survey results suggest they could gobble up even more of the yellow metal. Such banks snapped up 650 metric tons of the metal last year, which is worth more than $36 billion at recent the recent price of $1,740 a troy ounce.

Overall, three quarters of all the central banks that responded to the survey thought that global bank gold holdings would increase.

The reasons for believing that this gold rush will occur are legion, but the top two are important.

Higher Risks of A Financial Crisis

The first is fear of a global financial crisis. Six out of 10 of those who responded to the survey said that was a key reason for centrals wanting to hold gold.

Negative Interest Rates A Positive for Gold

Jointly topping the list of reasons for adding gold to a country’s national reserves is the “ongoing low to negative yields in advanced economy debt,” the report states. Negative interest rates mean that investors get back less money than the price they pay for the security.

Six out of 10 respondents said that was a key reason for the central banks to add gold.

Increased Central Bank Demand Should Boost Prices

Central banks tend to buy gold when they see the opportunity to obtain the metal at a good price. In practice that means they’ll likely choose to purchase bullion on price dips. That should mean that the market will not see huge falls or plunges over the long term. Or put another way, if you are investing in gold, such as the metal held in the SPDR Gold Shares (GLD) exchange-traded fund, then the trend should be in your favour.

A minted bar (left) and a cast bar (right)

Types

Based upon how they are manufactured, gold bars are categorized as having been cast or minted, with both differing in their appearance and price.[1] Cast bars are created in a similar method to that of ingots, whereby molten gold is poured into a bar-shaped mold and left to solidify. This process often leads to malformed bars with uneven surfaces which, although imperfect, make each bar unique and easier to identify. Cast bars are also cheaper than minted bars, because they are quicker to produce and require less handling.

Minted bars are made from gold blanks that have been cut to a required dimension from a flat piece of gold. These are identified by having smooth and even surfaces.

Security features

To prevent bars from being counterfeited or stolen, manufacturers have developed ways to verify genuine bars, with the most common way being to brand bars with registered serial numbers or providing a certificate of authenticity. In a recent trend, many refineries would stamp serial numbers even on the smallest bars, and the number on the bar should match the number on its accompanying certificate.

In contrast to cast bars (which are often handled directly), minted bars are generally sealed in protective packaging to prevent tampering and keep them from becoming damaged. A hologram security feature known as a Kinegram can also be inserted into the packaging. Bars that contain these are called Kinebars.

1 oz diffractive Kinebar

Bar in protective casing

Standard bar weights

Gold prices (US$ per troy ounce), in nominal US$ and inflation adjusted US$ from 1914 onward.

Gold is measured in troy ounces, often simply referred to as ounces when the reference to gold is evident. One troy ounce is equivalent to 31.1034768 grams. Commonly encountered in daily life is the avoirdupois ounce, an Imperial weight in countries still using British weights and measures or United States customary units. The avoirdupois ounce is lighter than the troy ounce; one avoirdupois ounce equals 28.349523125 grams.

The super-size is worth more than the standard gold bar held and traded internationally by central banks and bullion dealers is the Good Delivery bar with a 400 ozt (12.4 kg; 438.9 oz) nominal weight. However, its precise gold content is permitted to vary between 350 ozt (10.9 kg; 384.0 oz) and 430 ozt (13.4 kg; 471.8 oz). The minimum purity required is 99.5% gold. These bars must be stored in recognized and secure gold bullion vaults to maintain their quality status of Good Delivery. The recorded provenance of this bar assures integrity and maximum resale value.

• One tonne = 1000 kilograms = 32,150.746 troy ounces.

• One kilogram = 1000 grams = 32.15074656 troy ounces.

• One tola = 11.6638038 grams = 0.375 troy ounces.

• One tael = 50 grams.

• TT (ten tola) = 117 grams (3.75 oz)

Tola is a traditional Indian measure for the weight of gold and prevalent to this day. Many international gold manufacturers supply tola bars of 999.96 purity.

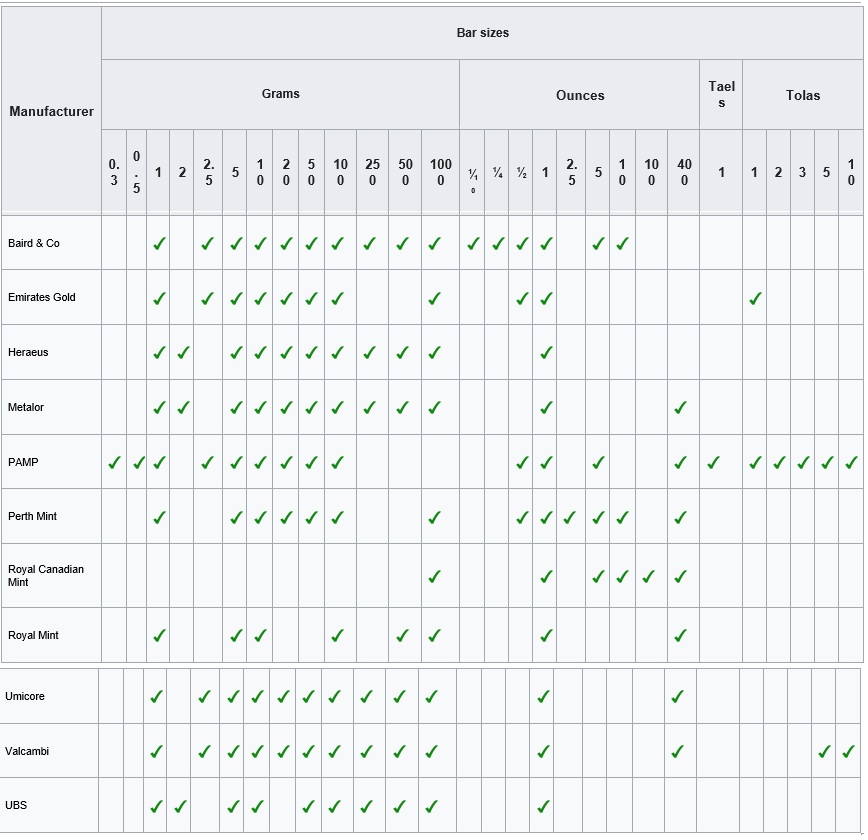

Manufacturers